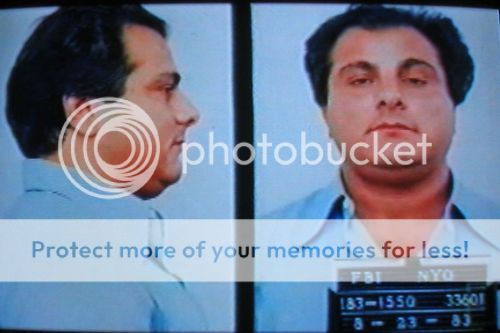

Gene Gotti

, behind bars since 1989 for running a multi-million dollar heroin distribution ring, is set for a Sept. 15 release from the Federal Correctional Institution in Pollock, La. The Long Island father of three, now 71, wore a white jogging suit and cracked wise about his upcoming prison time when surrendering in the last millennium at the Brooklyn Federal Courthouse.

, behind bars since 1989 for running a multi-million dollar heroin distribution ring, is set for a Sept. 15 release from the Federal Correctional Institution in Pollock, La. The Long Island father of three, now 71, wore a white jogging suit and cracked wise about his upcoming prison time when surrendering in the last millennium at the Brooklyn Federal Courthouse.Back in the ’80s heyday of his immaculately-dressed older brother and the Gambino family, FBI bugs captured Gene discussing topics from drug dealing to hiding illegal cash to changes in mob hierarchy.

The recordings of the Gambino capo and his mob associates became the first damaging domino to fall for the family in 1983, setting in motion the demise of their criminal empire.

What remains is a faint whisper of the roar that followed the ascension to boss of John (Dapper Don) Gotti, who took over after ordering the Dec. 16, 1985, mob assassination of predecessor “Big Paul” Castellano — in part to save his smack-dealing sibling’s life.

“What is Genie coming home to?” mused one long-retired Gambino family hand and Gotti contemporary. “There’s nothing left.”

When Gene Gotti started his 50-year prison bid, George H.W. Bush was in year one at the White House, an earthquake rocked the Bay Area World Series and the lip-syncing duo Milli Vanilli topped the charts.

Gene Gotti was convicted at his third federal drug-dealing trial, with jury tampering cited for a mistrial in the first one and a hung jury in the second. He and brother John were also cleared in a 1987 federal racketeering case where a juror was bribed.

Angel Gotti, Gene’s niece and the daughter of John, expects her uncle to find his footing in freedom.

“My uncle has been away 29 years so I'm sure he will be spending all his time with his wife, kids and grandchildren,” Angel told the Daily News.

Gene became one of five Gotti brothers to embrace “The Life” of organized crime. Though John emerged as the top gun, Gene earned his own spurs and became a valued mobster.

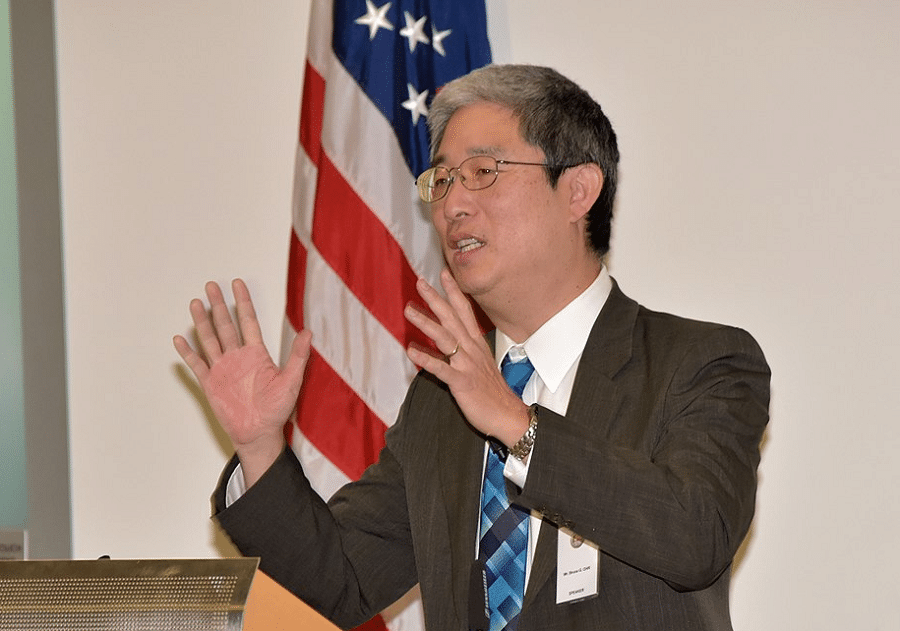

“He was a bona-fide wiseguy,” said ex-FBI agent Bruce Mouw, former head of the agency’s Gambino squad. “He wasn’t there because of his brother. He made it on his own.” But bona fide wiseguys are hard to find in 2018. Big brother John is dead 16 years, and sibling Peter appears destined to die behind bars, too. John’s namesake son Junior Gotti quit the mob after doing time for a strip club shakedown; he then survived four prosecutions that ended in mistrials. The Gotti crew’s Bergin Hunt & Fish Club in Ozone Park, Queens, is gone, replaced by the Lords of Stitch and Print custom embroidery shop.

Even the Mafia “brand” is down: The recently-released movie with John Travolta playing the “Teflon Don” grossed a mere $4.3 million — hardly “Godfather” numbers.

“The American Mafia has a recruitment problem: Who the hell wants to be a member?” said mob expert Howard Abadinsky, professor of criminal justice at St. John’s.

The new generation is filled with wanna-bes “who have either seen too many Mafia movies or losers who do not have the smarts or ambition for legitimate opportunity,” he added.

The older generation was not always a Mensa meeting, either — and Gene Gotti was Example A.

By the early 1980s, Gene was partnered with pals John Carneglia and Angelo Ruggiero in a lucrative heroin operation that ignored a Mafia edict against dope dealing. Gambino boss Castellano imposed a death penalty for violators, worried that drug convictions with lengthy jail terms provided an incentive for mobsters to rat out the family’s top echelon.

Gotti and his cohorts not only ignored the decree, they were caught discussing their drug dealing on an FBI bug planted in Ruggiero’s home. “Dial any seven numbers and it's 50/50 Angelo will pick up the phone,” a disgusted Carneglia later observed of his chatty cohort.

For Mouw, the recordings that led to Gene Gotti’s August 1983 arrest altered the landscape for the feds and the felons under their watch. “Without those conversations, a lot of things could have changed,” he said.

Instead, Castellano was soon pressing the Gotti faction for the damning tapes turned over by prosecutors as part of pre-trial discovery. The boss’ demand was greeted with excuses and delays, until Castellano was whacked 10 days before Christmas outside a Midtown steakhouse.

Decades later, it’s too late to change anything — including Gene’s decision to reject a plea deal that might have freed him after just seven years in prison.

“His brother John said no,” recalled Mouw. “He and Carneglia, they would have been home 20 years ago.”

The past is the past. What does the future hold for Gene Gotti?

“That’s the big question,” said Mouw. “Are you going to retire and enjoy your grandchildren? Or are you going to get active, and return to jail?"

Thanks to Larry McShane.